Introduction: A New Age in Accounting

Accounting is changing at breakneck speed. The era of ledgers, calculators, and manual data entry is over. Now, AI and automation are reshaping accountants’ work — from handling payroll and managing compliance to predicting finances.

This shift brings up a big question: Will AI take over accountants’ jobs?

The answer isn’t clear-cut as many believe. AI doesn’t aim to replace — it’s here to boost and transform the accountant’s job. Let’s examine how AI has an impact on the field and what lies ahead for accounting professionals.

AI won’t take over accountants’ jobs — it streamlines routine tasks so people can zero in on planning, review, and choosing what to do.

AI’s Expansion in Accounting: Our Current State

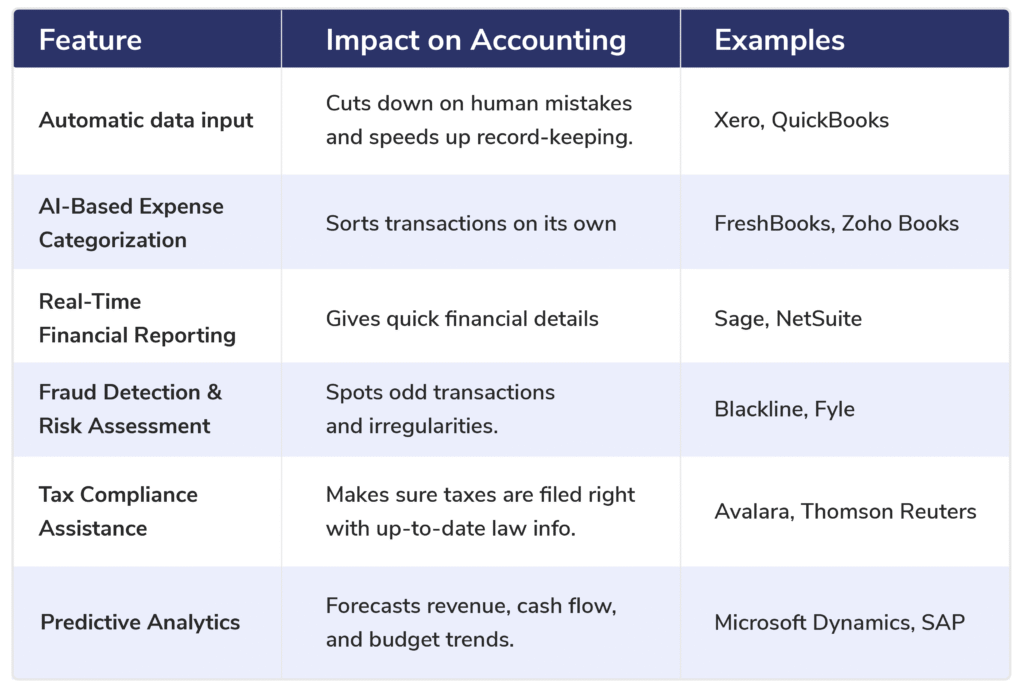

AI isn’t a thing of the future — it’s already part of most up-to-date accounting tools. Today’s AI-enhanced accounting software handle bookkeeping, balance checks, tax submissions, and even audit prep on their own.

Main AI-Driven Accounting Features

AI Accounting Market Growth

The worldwide AI-powered accounting software market is expanding :

- The global accounting software market will grow from $15.1 billion in 2023 to $26.6 billion by 2028, with a CAGR of 12.2%.

- By 2025, AI automation will take care of over 75% of everyday accounting tasks.

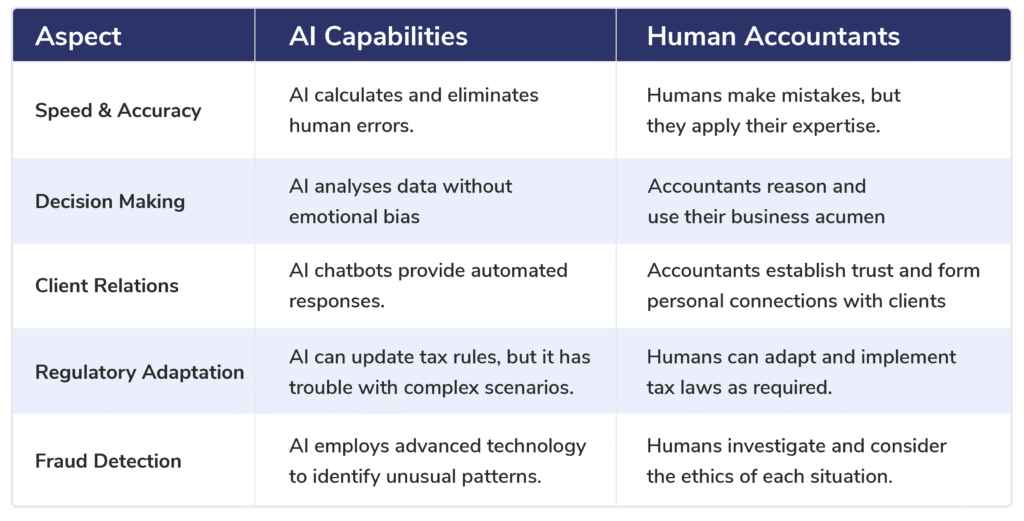

AI vs. Human Accountants: A Comparison ook:

AI boosts accounting productivity, but human accountants offer strategy, judgment, and ethical oversight that machines can’t match.

How AI-Powered Accounting Software Helps Businesses

AI is changing how companies handle financial data — shifting accounting from reactive to predictive.

1. Increased Productivity

AI automates routine tasks like data entry, reconciliations, and financial reporting — allowing accountants to concentrate on strategy and analysis.

2. Cost Savings

By automating their operations, businesses can reduce their accounting expenditures by up to 40%.

3. Instant Financial Insights

AI systems crunch data delivering real-time dashboards to improve cash flow management and forecasting.

4. Fraud Detection & Data Security

AI algorithms spot unusual transactions and fishy activity — stopping fraud before it happens.

Example: A company using AI analytics caught recurring tiny transactions that human checks didn’t see — saving thousands in potential fraud losses.

5. Compliance Made Easy

With changing Singapore tax and audit rules, AI tools keep up with IRAS and ACRA standards — making sure filings and reports always follow the rules.

What’s Coming Next for AI in Accounting (2025–2030)

AI’s part in accounting will keep growing — but working with humans, not taking their jobs.

New AI Trends to Keep an Eye On

- AI Assistants: Custom money bots that give quick answers and estimates.

- AI + Blockchain Integration: To make financial deals safe and unchangeable.

- AI-Driven Auditing: Non-stop, up-to-the-minute rule checks.

- Predictive Financial Planning: Clever guessing and budget tips.

Come 2030, AI will likely do most routine jobs — while human number-crunchers zero in on making sense of data giving advice and keeping things fair.

By 2030, AI will do 80% of accounting work, but human bean-counters will steer strategy, ethics, and money planning.

Final Thoughts: AI Is a Helper, Not a Stand-In

So, will AI replace accountants? No — but it will have a transformative effect on the profession.

AI excels at automating routine tasks, spotting patterns and boosting precision. But it can’t match the human judgment, ethical reasoning, and people skills that define true financial leadership.

In fact, the future of accounting is teamwork — where AI tackles the nuts and bolts and accountants bring out the significance.

For companies, this means using AI-enhanced accounting software alongside robust HRMS & Payroll tools to ensure compliance, accuracy, and quick decision-making.

AI won’t steal accountants’ jobs — it will provide them with improved tools to do their work.

Frequently Asked Questions:

Will AI take over accounting jobs?

No. AI makes routine tasks like data entry and reporting easier, but accountants still play a key role in judgment, compliance, and strategy.

What accounting tasks can AI perform now?

AI has the ability to handle bookkeeping, payroll, reconciliations, tax filings, and data analysis — giving accountants more time to focus on work that adds more value.

Can AI handle tax compliance in Singapore?

Yes. Many accounting systems powered by AI line up with IRAS tax rules on their own making sure submissions are on time and correct.

How can AI help small-medium businesses?

It cuts down on manual work, makes cash flow predictions better, and offers instant insights without the need to hire big finance teams.

What’s the future of accountants in an AI era?

Accountants will change into strategic advisors. They’ll make sense of data, make sure rules are followed, and come up with better business plans using what AI tells them.