The cloud has made accounting easier to access and manage, but there are also much greater security dangers than there were with old-fashioned paper-and-pen accountancy. It goes without saying that threat actors are capable of targeting and breaching even the most reliable IT systems. The fact that risks to internal accounting data are significantly more expensive is far more upsetting and dangerous.

Many individuals think there’s no connection between data security and accounting longevity. This is false. For instance, financial data risks might include blunders and unintentional data breaches in addition to hacking, demanding sophisticated solutions for data loss prevention. Accountants and accounting companies know that financial data leaks jeopardise their jobs, business growth, customer relationships, and other things.

Table of Contents

- 1. What Is the Role of Cybersecurity in Accounting?

- 2. Why is Cybersecurity Important for Accounting?

- 3. Risks to Financial Data Cybersecurity

- 4. Accounting Firms Must Adhere to The Following Security Requirements

- 5. Dependable Accounting Software Secures Financial Data

What Is the Role of Cybersecurity in Accounting?

Although most businesses are at risk from cyberattacks, accountants are particularly vulnerable because their systems hold enormous amounts of sensitive customer information and confidential information. They often include financial information, tax IDs, bank account details, salary details, investment information, future plans, and intellectual property. Any online criminal will be highly motivated to get this crucial data.

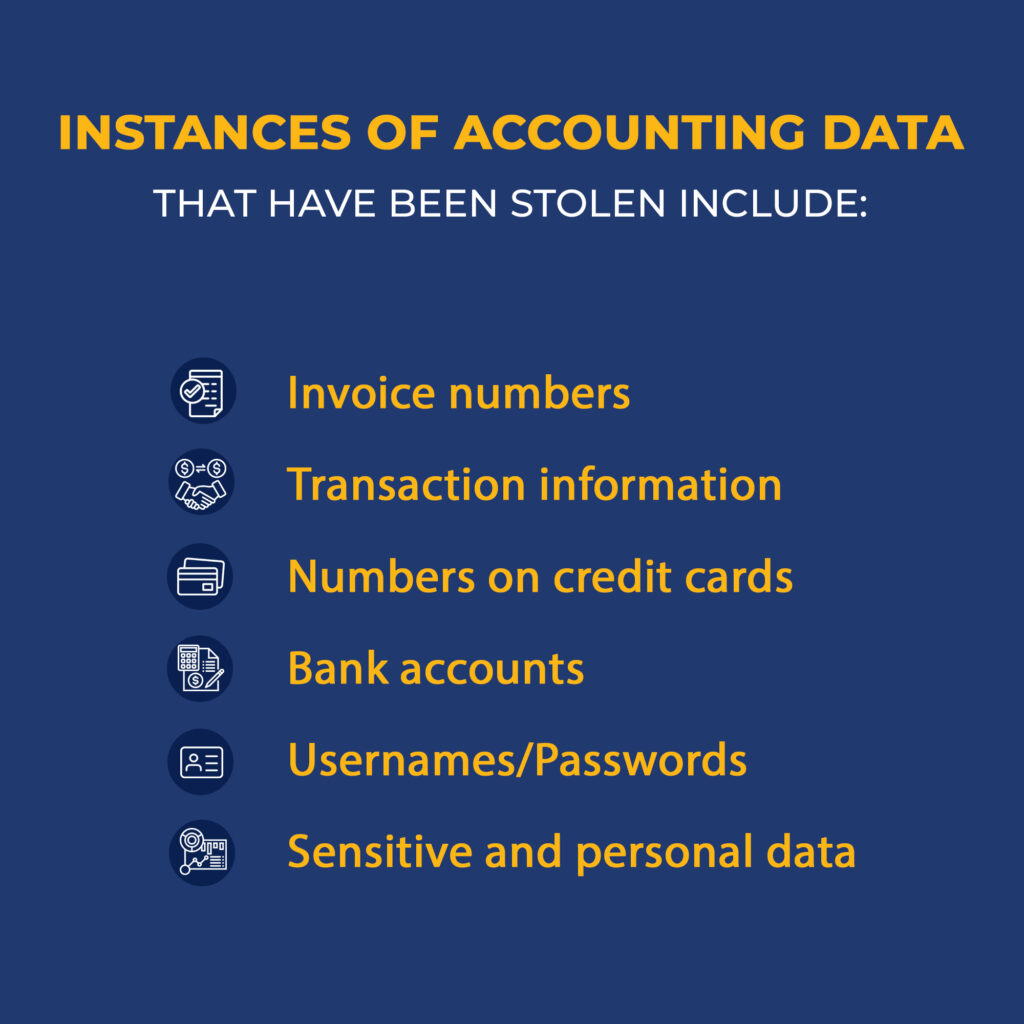

Instances of accounting data that have been stolen include:

- Invoice numbers

- Transaction information

- Numbers on credit cards

- Bank accounts

- Usernames/Passwords

- Sensitive and personal data

With the trends in accounting changing each year especially with Artificial Intelligence (AI) in accounting, hackers may find new ways to steal the data whether through direct hacking or creating AI’s that are capable of stealing accounting data.

The most serious risk is trusting that “my accounting company” or “my business’s performance records” are secure. Security breaches are becoming more common across all sectors of the financial services industry.

Why is Cybersecurity Important for Accounting?

Cybersecurity is becoming more and more crucial in the accounting industry. Accounting firms manage and store sensitive business information as well as valuable financial data. As a result, you must take extra care to safeguard yourself. The following details underline how crucial it is to take initiative when it comes to your financial data security:

- Attacks against networks have increased: Every year, the number of cyberattacks increases. 33 billion records will have been stolen by 2023, according to estimates, a 175% rise from 2018.

- Hacking is simple to conduct and takes minimal training: Contrary to popular belief, not all hackers are computer gurus. Using straightforward techniques like email phishing, which need no technical expertise, can be effective.

- Data belonging to your company and your clients are in danger due to security breaches: A security breach can, of course, cause substantial financial loss to your company, but it can also result in the theft of client information. A reputational injury and maybe legal action from the offended clients result from such a violation.

- Your reputation could be permanently harmed by cyberattacks: Your customers will understandably be hesitant to work with you going forward if your data has been compromised. It might take years before you restore your reputation, though.

Your customers rely on you to maintain precise financial records for them. Sensitive data may be stolen as a result of a financial data breach. Alterations to the client’s file made by the hacker might affect shareholder reporting, tax filing, and other crucial services. You have lost everything if your business loses the confidence of your clientele.

Risks to Financial Data Cybersecurity

Although there are many cybersecurity threats, many of these hacking techniques are not new. While some have advanced, others continue to function because computer users lose focus and composure. Among the most typical risks are:

- Phishing

Phishing is still one of the most popular and effective techniques for online criminals to acquire financial information. You will get an email that appears to be from an official source informing you that one of your accounts has been threatened and that you need to supply account details to resolve the problem. You cannot access the websites of your bank, credit card company, or other trustworthy businesses with the given web URL. Your computer is instead sent to the hacker’s website, where your private data will be utilised to access your accounts.

- Malware

Malware enters your network through downloads, thumb drives, etc. and takes the form of harmful code or software. This “hidden” virus can damage your operating system, apps, and data before you realize there is a problem. One of the biggest risks to network security is one that is readily spread from computer to computer in your business.

- Ransomware

One of the most expensive cyberattacks is ransomware. When ransomware attacks your network, you won’t be able to access your system unless you pay the ransom via an online payment method, frequently virtual money like bitcoin. An encryption key is held by cybercriminals until you accede to their demands. Naturally, paying the ransom carries risk because there is no assurance that your system will be unlocked. Getting rid of ransomware from your computer might be quite difficult.

- Spam

Scam emails give the impression to be ads for trustworthy goods and services. But, it’s possible to acquire a virus that may lock up your system or steal your data when you click on a link or download an attachment.

Accounting Firms Must Adhere to The Following Security Requirements:

- Avoid legal consequences

About 66% of clients would likely break relations with a firm if their sensitive data was leaked, while 94% would consider suing any of the entities engaged in data collecting. Additionally, cybersecurity will safeguard and defend your company’s data. It will also assist you in gaining the trust of your clients and expanding your business.

- Reduce financial loss

Cybercriminals nearly usually plan their assaults with the intention of stealing money from businesses. Small businesses are not immune to these dangers, and there are already many resources available to meet their need. You must have a robust cybersecurity strategy in place if you want to avoid a ransomware assault.

Data loss is costly and reduces the value of your firm. Whether or not your company is able to retrieve the data, the expense of cleaning up the mess is incalculable.

- Avoid data loss caused by insiders

Each employee in your organization has the capacity to hurt the firm. A lousy employee, for example, may sell knowledge to competitors for personal gain.

Suppose that the association has no impact on the behaviour of the representative. As a result, they may lose their high-valve accounting resources. Also, cyber security will sufficiently safeguard your data.

- Prevent the loss of your client’s financial information

Accountants are responsible for and must ensure the security of, their client’s financial information. Their responsibility is to appreciate the significance of their role in ensuring the security of their client’s data. Furthermore, a single human error might provide hackers access to a client’s financial information. As a result, cybersecurity contributes to the prevention of data breaches. Accounting professionals may improve their workplace productivity by getting online cybersecurity credentials.

Dependable Accounting Software Secures Financial Data

It is apparent that there are various advantages to employing cybersecurity in the accounting profession. Online cyber security training is an excellent technique to educate people about the advantages of utilizing it. Accounting businesses should recruit cyber security specialists and adopt cyber security to secure their essential data. Cybersecurity improves your brand’s long-term worth. It protects against any type of data breach or theft. It will also help them acquire the trust of their clients and grow.

Dependable accounting software helps protect your financial data in addition to assisting your accounting business in managing and analyzing finances more efficiently and effectively. Remember, you’re not just safeguarding your company; you’re also protecting your clients’ identities and data. Investing in a secure accounting platform is not only important but also a critical step in securing your company’s long-term viability. Not to mention the safety and well-being of your consumers.

Info-Tech accounting software provides all of the security measures you need to safeguard your accounting data from any cloud attacks securely. Our adaptability also allows you to customize these security elements to meet your specific requirements. Keep your accounting data safe, and you’ll keep your company and customers safe, not to mention satisfied.

Info-Tech is committed to addressing security issues so that you may use your accounting data successfully for your firm. Request a free demo today to learn how our solution protects your data from any future threats.