Navigating Singapore’s complex payroll regulations can be daunting for any organization. The country’s Ministry of Manpower (MOM) sets strict guidelines for employing foreign and local workers, making it crucial for companies to stay compliant with the regulations to avoid legal and financial penalties.

So, if you’re like me and are tired of pulling your hair out over this stuff, I’ve got some good news: MOM-approved payroll software can help you stay on top of things!

MOM-Compliant payroll software is like a supercharged payroll management system that’s authorized by the Ministry of Manpower (MOM) in Singapore. It’s specifically designed to meet MOM’s requirements and standards, so you can be sure it’s got all the bells and whistles to keep you compliant.

Table of Contents

- 1. What is Payroll Software

- 2. How Payroll Software Works?

- 3. How Important is Payroll Software in 2023?

- 4. Benefits of Payroll Software

1. What is Payroll Software?

Payroll software is a digital tool that businesses use to streamline their employee compensation processes. It takes care of all aspects of payroll management, such as calculating salaries, bonuses, and deductions, generating payslips, and filing payroll taxes.

With features such as time and attendance tracking, direct deposit functionality, and payroll reporting, payroll software makes it easier for businesses to manage employee payroll data and stay compliant with tax regulations and labour laws.

It can even be integrated with other HR management systems, such as Time Attendance, Leave, and Claims to create a comprehensive and efficient solution for managing employee compensation. By using payroll software, businesses can save time, reduce errors, and ensure accurate and timely employee payment.

2. How Payroll Software Works?

The whole payroll procedure needs to be carefully planned by a payroll administrator. Continuous monitoring of changes to tax withholding, contribution, and other factors to consider in the process is required to manage continuous duties that require attention.

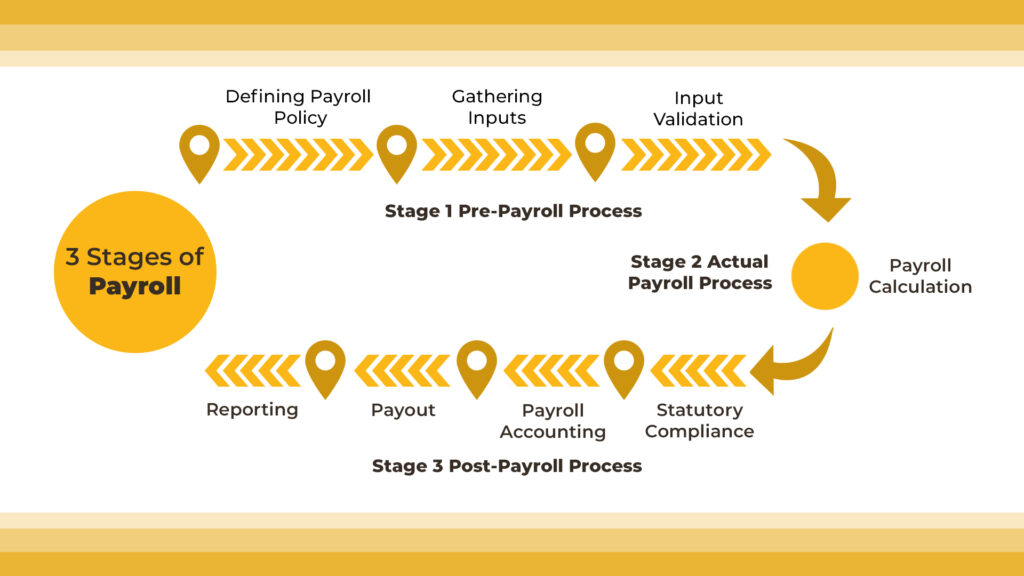

The payroll procedure may be broken down into three stages: pre-payroll, actual payroll, and post-payroll process.

Pre-Payroll Process

Defining policy: It’s critical to define a company’s policies at this early stage, including its pay policy, leave and benefits policy, and attendance policy.

Make sure that your company’s management has approved these regulations and that they are clearly stated to ensure consistent payroll processes.

Gathering Inputs: Interacting with other departments and payroll is frequently a crucial step in the payroll process. These are the folks who can provide you with more access to crucial data like attendance statistics and mid-year wage modifications.

In smaller enterprises, the process could be more concentrated, while in larger businesses, it might be more robust. Even while compiling this information might be burdensome, payroll software includes integrated capabilities like leave and attendance tracking, and management of leaves and absences.

Input validation: The process’s next phase is determining the accuracy of the input data and if it complies with corporate guidelines. Ensure that every current employee has been remembered and no inactive employee has been paid their wage at this time.

Actual Payroll Process

Payroll calculation:This step in the payroll process involves entering data into the payroll system to carry out the actual payroll processing. After optimizing the applicable taxes and deductions, the procedure generates net pay.

Post-Payroll Process

Statutory compliance:All required deductions, such as the Central Provident Fund (CPF)), Skill Development Levy (SDL), and Foreign Workers Levy (FWL), are made at the time of processing. The proper government entities get the money when it has been sent by the payroll administrator.

Payroll Accounting: Every business must maintain a complete record of all financial activities. One of the most important components of operational costs that must be entered in your book of accounts is salary. The accounting system for the organization should constantly be appropriately updated with all wage and reimbursement information, according to payroll management.

Payout: Salary payments may be made in cash, checks, or bank transfers. Salaries are often paid straight into an employee’s bank account by businesses.

Once payroll is completed, a business must make sure there is enough cash in the bank account to cover salary payments.

Reporting: Your finance department or management team would request a report on items like department employee expenses or location employee costs once you’ve finished payroll for a given month.

To distribute these reports, a payroll administrator will need to collect the data and extract the necessary information.

3. How Important is Payroll Software in 2023?

Payroll software is becoming increasingly important in 2023. With businesses operating in a rapidly changing economic environment, HR professionals are under more pressure than ever to ensure accurate, timely, and compliant payroll processing.

Additionally, the rise of remote work and mobile technology means that employees expect to access their payroll information from anywhere, at any time. Payroll software allows businesses to meet these expectations, providing mobile and web-based access to employee pay and benefits information.

4. Benefits of Payroll Software

There are several benefits of having payroll software for your business:

1. Saving time: Payroll software automates several payroll procedures, including calculating employee wages, deducting taxes, and producing payslips. HR professionals may concentrate on other crucial responsibilities by cutting down on the time needed to accomplish these duties manually.

2. Accuracy: Complex calculations are performed by payroll software, lowering the possibility of human mistakes. This minimizes the possibility of disagreements or legal concerns by ensuring that employee pay and tax deductions are precise.

3. Compliance: Payroll software aids firms in adhering to tax and employment laws. It creates reports for compliance needs and computes tax and other deductions in accordance with the most recent laws.

4. Integration: Payroll software may connect to other HR management programmes to offer a complete employee data management solution.

5. Cost-Saving: Payroll software saves organisations money by reducing the need for extra HR personnel. Additionally, it does away with the necessity to outsource payroll processing, bringing down the price of using third parties.

Info-Tech: Singapore’s Best MOM-Compliant Payroll Software

From the process itself, there are bound to be doubts about ensuring every process is perfectly executed without errors or delays in payroll administration. Not to mention, keeping up with MOM’s policy can be a hassle. This is why Info-Tech is here to help you!

Info-Tech’s payroll software is MOM-compliant, meaning that the necessary deductions and tax rates are automatically integrated according to MOM’s contribution policy. Its features and benefits make it an essential tool for businesses of all sizes, enabling them to streamline payroll processing, reduce errors, ensure compliance with tax and labour regulations, and provide employees with a self-service portal.